The establishment of the Single Supervisory Mechanism (SSM) introduced many tools for effectively supervising banks at the European level. One of those tools, which is possibly not always highlighted enough, allows the ECB to impose sanctions on supervised banks that fail to comply with prudential requirements.

This power of the ECB was conceived in the SSM founding regulation

as one of the preconditions for European banking supervision to be

credible and impactful. In particular, our sanctioning power is expected

to foster a culture of prudential compliance among institutions subject

to European regulatory requirements and the ECB’s supervision.

That

is why sanctions are part of the ECB supervisory toolkit, together with

enforcement measures which, unlike sanctions, can only be used when a

breach of prudential requirements is still ongoing. The aim of these

tools is threefold.

First, they contribute to effective

supervision: direct enforcement powers help the ECB ensure and restore

compliance with prudential requirements. This, in turn, creates

confidence in the soundness of the banking system and promotes its

stability.

Second, they stop banks benefiting from breaching

prudential requirements: non-compliance should not provide undue

benefits to banks, including competitive advantages.

Third, and

very importantly from a prudential forward-looking point of view, the

deterrence penalties discourage banks from committing similar breaches

in the future, which promotes a compliance culture in the banking system

and thus contributes to its stability.

In the European context

there are a number of challenges for the implementation of a compliance

culture. First, the previous fragmentation of supervisory jurisdictions

implied different approaches to compliance. For example, some

jurisdictions were more likely to impose sanctions, while others perhaps

preferred other types of interventions. Second, the enforcement and

sanctioning legal framework can be complex in certain instances,

especially in terms of the interplay between European and national laws

and powers.

Against this background, this blog post aims to

clarify the framework in place for the exercise of the ECB’s enforcement

and sanctioning powers in the area of prudential supervision. More

specifically, it focuses on the recent publication of the ECB Guide to the method of setting administrative pecuniary penalties.

Scope of the ECB’s enforcement and sanctioning powers

Let

us begin by recalling which prudential requirements are under the

supervision of the ECB. We are entrusted with ensuring banks comply with

prudential requirements in the areas of own funds, capital

requirements, large exposure limits, liquidity, leverage and reporting,

and the public disclosure of information on those areas. These

requirements are laid down in directly applicable EU law, such as the

Capital Requirements Regulation (CRR).

In addition, we are tasked

with ensuring that banks comply with prudential requirements in the area

of governance, including fit and proper criteria, risk management,

internal controls and remuneration policies and practices. These

requirements are laid down in national law implementing the Capital

Requirements Directive (CRD).

The scope of our enforcement and

sanctioning powers in banking supervision is, therefore, limited to

breaches identified in the abovementioned areas. In contrast, the

supervision and enforcement of the requirements imposed on banks in the

areas of consumer protection or anti-money laundering fall exclusively

under the remit of the national authorities. The ECB cooperates with

those authorities to ensure a high level of consumer protection and to

fight against money laundering. In our prudential assessment, we also

consider the shortcomings identified in those areas when they reveal

failures in banks’ internal control and governance arrangements.

However, the ECB has no enforcement or sanctioning power to ensure

compliance with consumer protection or anti-money laundering rules.

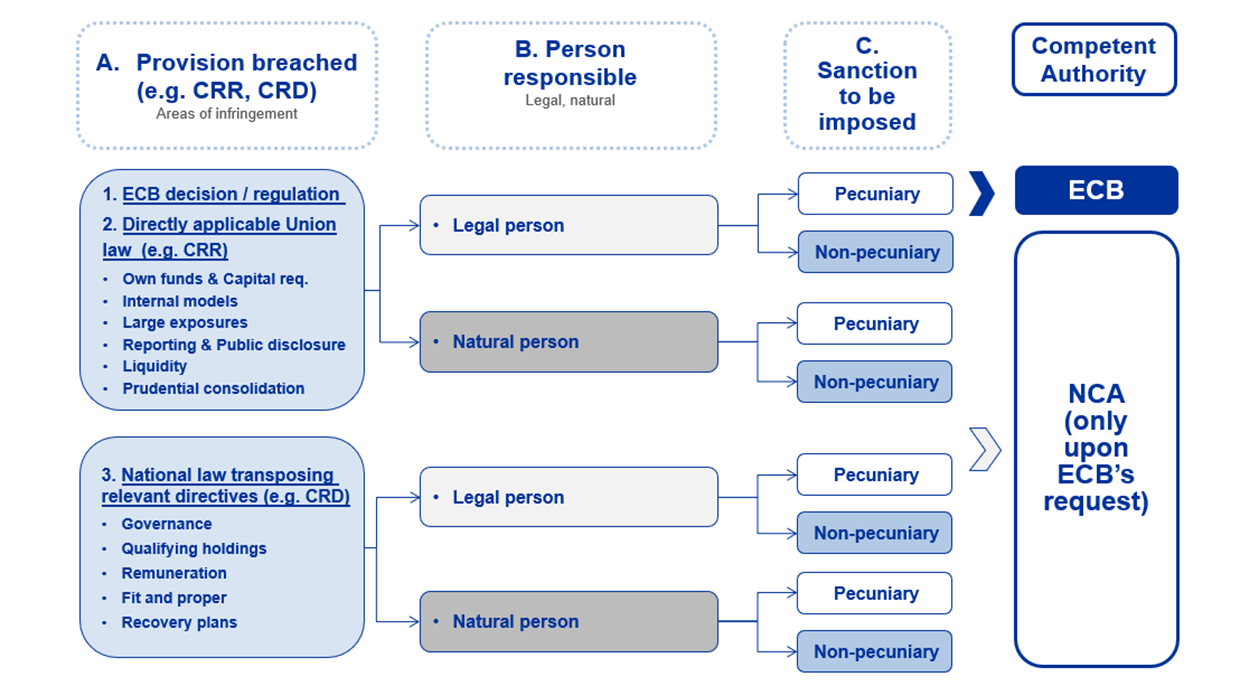

Allocation of sanctioning powers within the framework of the SSM

The

allocation of sanctioning powers within the framework of the SSM is

complex, as it depends on three different elements: (i) the type of

provision breached (i.e. directly applicable EU law or national law

implementing directives imposing prudential requirements); (ii) the

persons responsible for the breach (i.e. legal persons or individuals);

and (iii) the type of penalty to be imposed (i.e. pecuniary or

non-pecuniary).

The ECB can sanction both significant and less

significant institutions in the event of breaches of ECB regulations or

decisions. In addition, we can sanction significant institutions for

breaches of directly applicable EU banking law (e.g. the CRR).

The

direct enforcement and sanctioning powers of the ECB are limited to

pecuniary penalties imposed on legal persons. In other words, the ECB

cannot directly impose other types of penalties, such as a public

warning, on legal persons, nor can it sanction natural persons in any

manner.

To ensure the effectiveness of these powers throughout the

banking union, the ECB is entitled by law to request that the national

competent authorities (NCAs) open proceedings. This may happen in three

situations. First, in the case of breaches of national law implementing

directives (e.g. the CRD). Second, if the ECB considers that

non-pecuniary penalties, as provided for in national laws (i.e. a public

warning), should be imposed. Third, if the ECB considers that natural

persons should be sanctioned. NCAs remain fully competent to impose

sanctions on both significant and less significant institutions in the

case of breaches of national law not implementing EU directives or of

national law implementing EU directives unrelated to the ECB’s

supervisory tasks.

Figure 1

Allocation of sanctioning powers within the SSM: significant institutions

Source: ECB Banking Supervision

Identification of breaches: day-to-day supervision and whistleblowing mechanism

As

soon as we identify shortcomings in a bank, we may adopt supervisory

measures, such as capital add-ons, restriction of business or

operations, divestment of activities that pose excessive risks to the

bank’s soundness, restriction or prohibition of dividend distribution,

ask the bank to reinforce its governance arrangements, etc. These

measures focus on preventing breaches and aim to ensure that banks

address their weaknesses at an early stage.

While supervisory

measures are initiated by Joint Supervisory Teams (JSTs), enforcement

and sanctioning measures are handled by the ECB’s Enforcement and

Sanctions Division (ESA), which is an independent unit in ECB Banking

Supervision. As ESA is not involved in day-to-day supervision, suspected

breaches of prudential requirements are normally identified by the JSTs

or other relevant business areas responsible for the direct and

indirect supervision of banks, who then refer these suspected breaches

to ESA for further investigation.

In addition, any European

citizen can contribute to the identification of breaches. If you are a

bank customer or employee who suspects that your bank has breached EU

banking supervision law, you can share your suspicions with us via our whistleblowing platform,

which is also operated by ESA. The ECB never reveals the identity of a

person who makes a report without first obtaining that person’s explicit

consent, unless such disclosure is required by a court order. We are

also constantly improving the security of our platform and its technical

capacities. For example, we offer European citizens the possibility to

report suspected breaches of prudential requirements in several

languages, and we continue to expand the number of languages available

on the platform.

Investigation of suspected breaches and subsequent steps

As

soon as a suspected breach is identified and referred to ESA, it

conducts all the necessary investigation to clarify the facts and

relevant circumstances of the case, including those relating to the

impact of the breach and the level of misconduct of the bank. For this

purpose, ESA may request documents and explanations. It may also examine

books and records, conduct interviews and exercise other investigatory

powers if necessary.

© ECB - European Central Bank

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article