Welcome to our Gold Friends weekly e-mail.

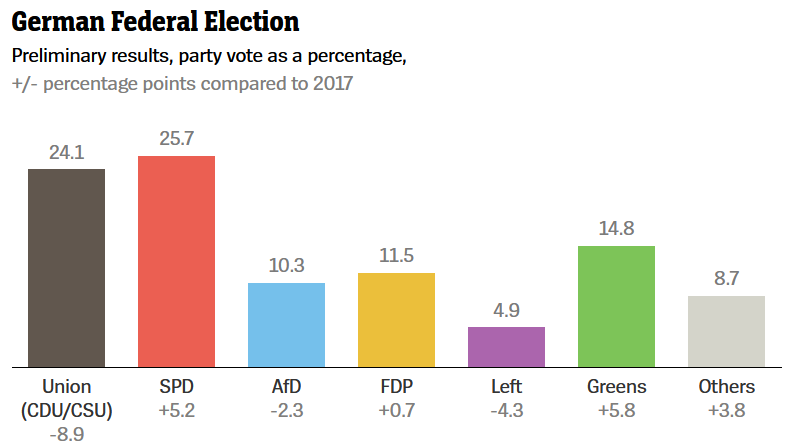

Highlights of my week: The German election turned out to be even more inconclusive than expected but forcing Greens and FDP to work together could yet produce a positive outcome. However, CoFE trundles on and the European Policy Centre published a scenario analysis for 2035 on the different models of EU integration as the new German government will have a key influence. “Muddling upwards” seems most likely – did they glance at the history of the last couple of decades? The EBA looked at the impact of Basel III and concluded CET1 may have to rise another 14%. ESMA was also busy: reports on algo trading and settlement fails plus consultations on short selling and best execution. CEPS felt obliged to issue a clarification on the (mis) use of its AI Act analysis! Country-by country tax reporting is now agreed.

Brexit produced more strange twists: there may soon be a shortage of bankers as well as HGV drivers... and the City of London has turned to the Labour party for political support…

Graham Bishop

Articles from 24-30 September 2021

General Financial Policy

Der Spiegel: Difficult Talks Ahead for Greens and Free Democrats : The Green Party and the business-friendly Free Democrats plan to hold exploratory talks with each other before meeting with the main chancellor candidates in the coming days. They appear to be worlds apart but are already finding some common ground. View Article

Eurogroup's Paschal Donohoe at the Inter-parliamentary Conference on Stability, Economic Coordination and Governance in the : Overview of economic situation, RRF, RRF financing, own resources and tax View Article

ECB President Lagarde: ECON Hearing - the new monetary policy : I will outline some of the key elements of our new strategy and provide an update on the outlook for the economy and for inflation, together with some reflections on our current monetary policy stance. Then, at the explicit request of this Committee, I will discuss the topic of financial dominance. View Article

Finance Watch: Debunking eight tales about European public debt and fiscal rules : Those rules are built on a series of debatable conceptions about public debt and the role played by the state. This paper focuses on debunking eight often-espoused conceptions. View Article

EPC: Differentiated EUrope 2035: Elaboration and Evaluation of Five Potential Scenarios : Differentiated integration has been and will remain a necessity if Europe wants to overcome stalemate and improve the functioning of the European integration process. View Article

Banking Union

EBA launches 2021 EU-wide transparency exercise : Transparency exercises are conducted on an annual basis and are part of the EBA's efforts to monitor risks and vulnerabilities and to reinforce market discipline View Article

The EBA publishes its regular monitoring Report on Basel III full implementation in the EU : The full Basel III implementation would result in an average increase of 13.7% on the current Tier 1 minimum required capital of EU banks. To comply with the new framework, EU banks would need EUR 3.1 billion of additional Tier 1 capital. View Article

SRB bi-annual reporting note to Eurogroup : This note is aimed at reporting to Eurogroup on the SRB’s (1) forward looking approach to its 2022 priorities in terms of banks’ resolvability and (2) update regarding the operationalisation of the Single Resolution Fund, including the recent ex-ante contributions’ Court rulings. View Article

GBIC comments on the current EBA consultation on draft SREP guidelines and supervisory stress testing : GBIC welcomes the decision to update the SREP Guidelines. We also agree with the overarching objectives, namely (a) to increase convergence of practices followed by competent authorities across the EU, and (b) to align the SREP Guidelines with other relevant EBA guidelines and technical standards. View Article

Capital Markets Union

ESMA: MiFID II/MiFIR review report on Algorithmic Trading : Many provisions and requirements of MiFID II relate either directly or indirectly (e.g. direct electronic access or tick sizes) to algorithmic trading. View Article

ESMA consults on proposals for a review of the MiFID II best execution reporting regime : ESMA launches a consultation on proposals for improvements to the MiFID II framework on best execution reports. These proposals aim at ensuring effective and consistent regulation and supervision and enhancing investor protection. View Article

ESMA consults on the review of the Short Selling Regulation : ESMA will consider the responses it receives to this consultation paper by 19 November 2021 and expects to publish a final report by the end of Q1 2022. View Article

ESMA: Final Report Guidelines on Settlement Fails Reporting under Article 7 of CSDR : ESMA is also very much looking forward to the publication of the European Commission legislative proposal - expected by the end of the year. However, this timing will collide with the expected entry into force of the current CSDR settlement discipline regime on 1st February 2022. View Article

ICMA publishes overview of the European commercial paper market and recommendations for future market development : There is no single pan-European market for commercial paper. View Article

Insurance Europe: Insurers call for refinements to facilitate more securitisation investment to underpin EU economic growth : The insurance sector supports the promotion of sound securitisation and an appropriate prudential treatment, in line with the objectives of the Capital Markets Union project. View Article

ALFI responds to the EC consultation on the functioning of the EU securitisation framework : ...some of the rules contemplated by the SECR have generated some adverse effects, such as disadvantaging EU institutional investors in certain segments of the market. View Article

Environmental, Social, Governance (ESG)

Insurance Europe: Insurers welcome EC proposal for EU Green Bond Standard and suggest refinements to ensure its uptake : As Europe’s largest institutional investor, the industry supports measures to stimulate the development of the green bond market. View Article

GBIC welcomes proposal for an EU standard for green bonds – further revisions necessary : Several amendments to the proposed regulation are necessary to enable issuers to help stimulate the green bond markets and to make the European Green Deal a reality. View Article

Insurance Europe: Insurers welcome EFRAG’s development of sustainability reporting standards and offer support through expert groups : Sustainability data plays a particularly important role for insurers who, as well as being preparers of ESG data, are the largest institutional investor group. ESG data from investee companies is therefore vital View Article

EURACTIV: The EU taxonomy can strengthen SMEs in the green transition : Small and medium-sized companies will remain exempt from new disclosure rules on the EU’s sustainable finance taxonomy starting in 2022. However corporate leaders would be well-advised to follow its implications, including SMEs, writes Finn Wendland. View Article

Release of SASB Standards XBRL Taxonomy Accelerates Structured Reporting of ESG Data : Key objectives of the Taxonomy are to simplify the disclosure process for businesses and improve the quality,usefulness and comparability of environmental, social, and governance (ESG) disclosures to investors. View Article

ACCA: Create, protect and sustain value – the role of accountants as trusted professionals at the heart of sustainable organisations : Analysis from ACCA (the Association of Chartered Certified Accountants) uncovers the drivers of change shaping sustainable business and the must-have capabilities needed from accountants as sustainable business and finance professionals of the next decade. View Article

Protecting Customers

BEUC: PUBLIC CONSULTATION ON THE DIRECTIVE ON DISTANCE MARKETING OF CONSUMER FINANCIAL SERVICES : It is crucial for EU legislation to adequately protect consumers when theypurchase financial services at a distance, regardless of the means of communicationused. View Article

Fin Tech Regulation

Proposal for a regulaton laying down harmonised rules on AI act: EBF response : The Act aims to develop an ecosystem of trust for AI in the EU, which encourages investment, aims to strengthens competitiveness and to ensure that AI systems respect fundamental rights and EU values. View Article

CEPS: Clarifying the costs for the EU’s AI Act : The figures in the CDI paper are based on a study, which we at CEPS conducted ... the CDI paper contains incorrect and spurious information concerning the prospective cost of the proposed AI Act. View Article

OECD: More efforts needed to boost trust in AI in the financial sector, says OECD : Governments, financial regulators and firms should step up their efforts to work together to address the challenges of developing and deploying trustworthy artificial intelligence (AI) in the financial sector, according to a new OECD report. View Article

Economic Policies Impacting EU Finance

Public country-by-country reporting: Council paves the way for greater corporate transparency for big multinationals : The Council today adopted its position at first reading on the proposed directive on the disclosure of income tax information by certain undertakings and branches, commonly referred to as the public country-by-country reporting (CBCR) directive, paving the way for its final adoption. View Article

MEP Sven Giegold: Council approves public Country-by-Country Reporting: new era of tax transparency : Council approved the outcome of negotiations between member states, the European Parliament and the European Commission on public country-by-country reporting ("trilogue outcome"). Sweden and Cyprus voted against, the Czech Republic, Ireland, Luxembourg and Malta abstained, which is generally seen as a rejection. View Article

Brexit and the City

TheCityUK: Financial services access to global high-skilled talent needs streamlining and lower costs : Over nine months on from the introduction of the UK’s 2021 immigration system, financial and related professional services firms are seeing significant cost increases to securing the high-skilled talent that they need to compete on the global stage. View Article

Veron: Brexit and European Finance: Prolonged Limbo : the full impact of Brexit on the financial sector has been delayed by risk aversion.... in part related to the Covid-19 pandemic. It will take longer than many had anticipated for the dust to settle on the post-Brexit financial landscape and its respective implications for the EU and the UK. View Article

POLITICO: City of London seeking more action, not words, on deregulation : The future of the UK’s finance industry is to be decided by key policy changes in the coming months.The pandemic and Brexit drove British bankers and politicians back into each other’s arms after a period of acrimony. But will the rekindled relationship last? View Article

SSM's Fernandez-Bollo: Banking regulation and supervision after Brexit : On the European side, we need to have a comprehensive view of the potential risks banks are exposed to as well as the effective capacity to manage and supervise them. To do so, further amendments to the European framework may be necessary. View Article

EURACTIV: New York, London keep top spots in global financial centres index : New York easily kept the top spot in the latest Global Financial Centres Index (GFCI), while London held on to second place as Chinese cities slipped, according to the ranking published on Friday. View Article

City Corporation calls on Labour to help the financial sector support the economic recovery :The City of London Corporation is today calling on the Labour Party to support and promote the growth of financial and professional services across the UK in order to boost the national economic recovery post-pandemic. View Article

ICMA responds to HM Treasury Wholesale Markets Review : The response was drafted primarily by ICMA’s MiFID II transparency taskforce but a few responses also take into account the views of ICMA’s other working groups and committees, such as repo and primary markets. View Article

AFME responds to UK Treasury Wholesale Markets Review : Adam Farkas, Chief Executive of AFME, said: “The UK Wholesale Markets Review is a key moment for the industry and policy makers to reflect on how well capital markets are functioning. .. View Article

ICMA responds to HM Treasury’s UK Prospectus Regulation Regime Review : HM Treasury’s proposed approach does not give rise to these concerns immediately, although much will depend on the precise approach taken with respect to exemptions from the public offer regime and the approach taken in relation to “wholesale” disclosure for bonds admitted to trading on UK markets. View Article

Follow us on

About this email

If you do not wish to receive these e-mails, please click this link If you wish to add a colleague, please inform: office@grahambishop.com

Euro Crisis Limited PO Box 2002, Battle, East Sussex, TN33 0WL, UK Tel:+44 (0)1424 777123 Email: office@grahambishop.com (Registered in England and Wales No. 7984039)

|