Welcome to our Gold Friends weekly e-mail.

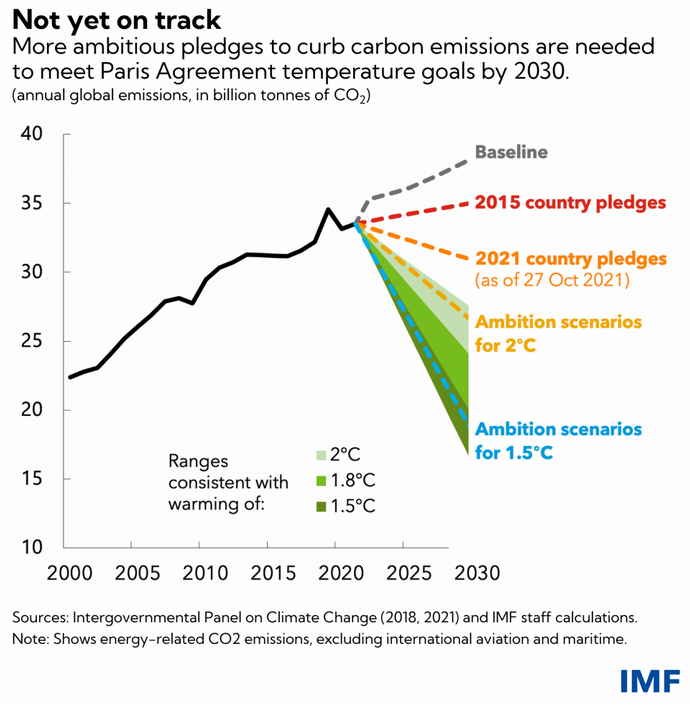

Highlights of my week: COP26 was the only event in town this week – unsurprisingly! An IMF chart gives the whole story in a glance below – starkly. International bodies, professional associations, think tanks etc – all lined up to give their support to the lofty goals. But real progress is also happening on the `financial’ ground: as expected, the IFRS Foundation announced the formation of the International Sustainability Standards Board (ISSB) – to be located in Frankfurt so existing EU standards could easily be influential. Key global financial regulators announced their support for the ISSB so its global standards will surely become embedded in financial regulation everywhere. The G20 meeting was rather overshadowed but the OECD was pleased to receive its endorsement to bring the `BEPS’ rules into force in 2023.

(I published another article in my `Brexit and the City’ series – contemplating the impact of third country rules for non-EU banks, and the forthcoming ESMA pronouncements on CCP location.)

Graham Bishop

Articles from 29 October - 4 November

General Financial Policy

IMF's Georgieva: Not Yet on Track: Climate Threat Demands More Ambitious Global Action : As world leaders gather in Glasgow for COP26, a new IMF Staff Climate Note shows unchanged global policies will leave 2030 carbon emissions far higher than needed to “keep 1.5 alive.” View Article

The ECB pledge on climate change action : On the occasion of the 2021 United Nations Climate Change Conference (COP 26),the ECB pledges to contribute, within its field of responsibility, to decisive action bypolicymakers to implement the Paris Agreement and mitigate the consequences ofclimate change. View Article

Bruegel: Is the ECB right to take on climate change? : The real issue here is not that the ECB takes a very sizeable risk by pursuing climate objectives but rather, that it cannot afford not to. And by doing so, it helps establish just how urgent climate change is. View Article

POLITICO: Christian Lindner as German finance minister: Does he add up? : Liberal leader has big ambitions but faces questions about his credentials. View Article

Federal Trust - Hoeksma:A Definition of the EU as Farewell Present for Chancellor Merkel : A democratic Union of democratic States: Jaap Hoeksma, Philosopher of Law, is the author of "The European Union: A democratic Union of democratic States". His idea on Democratic Citizenship Education for the Conference on the Future of Europe can be endorsed here. View Article

Banking Union

EBA consults on the amendment to its technical standards on strong customer authentication and secure communication in relation to the 90-da : The proposed amendment aims at addressing issues in the application of the exemption by some account servicing payment service providers (ASPSPs) across the EU States - resulting in a negative impact on the services offered by account information service providers (AISPs) under the PSD2. View Article

ESBG: The EU Commission’s proposed ‘single-stack’ approach for Basel III finalisation would harm European banks : The European Savings and Retail Banking Group (ESBG) calls on the European Parliament and the Council of the EU to reconsider the output floor implementation on a ‘single-stack’ approach included in the European Commission’s proposal for the finalisation of the Basel III standards in the EU, announced today View Article

Capital Markets Union

BIS: Non-bank financial intermediaries and financial stability : NBFIs' prominent role has brought benefits by diversifying funding sources, but it has also exacerbated some liquidity imbalances that can, in extreme cases, endanger financial stability. View Article

PensionsEurope: PensionsEurope feedback to the Commission on its WHT roadmap : PensionsEurope welcomes the Commission’s roadmap on the new EU system for the avoidance of double taxation and prevention of tax abuse in the field of withholding taxes (WHT). View Article

EIOPA: Risk Dashboard: European insurers’ risk levels remain broadly stable : The results show that insurers’ exposures to macro risks remain at a high level while all other risk categories, such as insurance as well as profitability and solvency risks, stay at medium levels View Article

Environmental, Social, Governance (ESG)

IFRS Foundation announces International Sustainability Standards Board, consolidation with CDSB and VRF, and publication of prototype disclo : IFRS Foundation Trustees (Trustees) announce three significant developments to provide the global financial markets with high-quality disclosures on climate and other sustainability issues: View Article

G20 supports IFRS Foundation sustainable standard-setting - and much else : We welcome the agreement by Finance Ministers and Central Bank Governors to coordinate their efforts to tackle global challenges such as climate change and environmental protection, and to promote transitions towards green, more prosperous and inclusive economies View Article

Basel Committee supports the establishment of the International Sustainability Standards Board : The Committee supports the IFRS Foundation's proposed approach to developing globally consistent disclosures by working with relevant standard setters and building on existing initiatives and frameworks, including the Task Force on Climate-related Financial Disclosures (TCFD). View Article

EFAMA supports the formation of the International Standards Setting Board : The investment management industry is keen to actively engage in its governance and technical work, as it develops. View Article

IFRS Foundation ´s International Sustainability Standards Board on the Right Track, Says IOSCO : If the ISSB’s future standard meets IOSCO’s expectations, our endorsement willsupport all our 130 members in considering ways they might adopt, apply or be informed by thestandard. View Article

OECD Development Assistance Committee commits to align development co-operation with the goals of the Paris Agreement : Joint Declaration ahead of COP26 committing to align official development assistance (ODA), which totalled USD 161 billion in 2020, with the goals of the Paris Agreement on Climate Change. View Article

UNEP FI delivers G20 input paper with recommendations for credible net-zero finance commitments : By defining net-zero, the new guidance will help financial institutions achieve consistency in target setting and implementation of their net-zero goals. View Article

UNEP FI BLOG: Eric Usher discusses what makes a credible net zero commitment : Finishing the pre-COP series by considering how significant the net-zero objective has become for the finance industry, and what’s needed to make this a credible game changer going forward. View Article

UNEP FI: Net-Zero Asset Owner Alliance responds to reclaim finance report : Asset owners themselves must raise ambition to achieve robust interim emission targets for which they are accountable. View Article

UNEP FI: Net-Zero Banking Alliance reaches milestone with over 90 banks committed : Leading the 1.5 Degree Journey: Aligning the Banking Sector. This is also the drive behind the industry-led, UN-convened Net-Zero Banking Alliance, the banking element of the Glasgow Financial Alliance for Net Zero View Article

ESMA: European enforcers target COVID-19 and climate-related disclosures : This year’s priorities cover the impact of COVID-19 and climate-related matters,provide guidance on the measurement of expected credit losses and highlight disclosureobligations pursuant to Article 8 of the Taxonomy Regulation. View Article

CFA Institute Releases Global ESG Disclosure Standards for Investment Products : New Standards mark the first global voluntary standards for disclosing how investment products consider ESG issues in objectives, investment strategy, and stewardship View Article

EIOPA commits to support the insurance and pensions sectors’ efforts to tackle climate change : Climate change poses material risks to the assets and liabilities of insurers and pension providers. At the same time, given their role as society’s risk managers and important long-term investors, insurers and pension funds have a unique opportunity and responsibility to address climate change-related challenges. View Article

IAIS issues statement in advance of COP26 : The IAIS will continue to support its Members to further strengthen their focus on actions taken by insurers to assess and address climate-related risks and to support an orderly transition to net-zero. View Article

EPC: The European Green Deal: How to turn ambition into action : The EU can do this by acting as a rule-maker and enforcer; an economic powerhouse; a source of significant funding within the EU and beyond, a mobiliser for private financing; a convening power; an innovator and developer of new solutions; as a standard-setter; as a major producer and consumer. View Article

CEPS: COP26 in Glasgow : Don’t give up on Paris – the climate ambition ratchet may be working View Article

ICMA: EU Taxonomy Regulation Article 8 and unintended negative consequences for the development of the green bond market : ICMA is recommending either the urgent review of the exclusion of green and sustainability bonds of central governments, central banks and supranational issuers from the calculation of the GIR and GAR in the draft Delegated Act supplementing Article 8 of the Taxonomy Regulation. View Article

Setting regulatory and supervisory expectations for asset managers is fundamental to address greenwashing concerns, says IOSCO : There have been challenges associated with the growth of ESG investing and sustainability-related products in recent years, including a greater need for consistent, comparable, anddecision-useful information and the risk of greenwashing. View Article

Dutch Financial sector on track with its Climate Commitment : 89% of the financial institutions participating in the Dutch Financial Sector Climate Commitment have measuring the CO2 impact of their financing and investment activities. In addition, 51% of the signatories have drawn up action plans to contribute to the Paris Agreement. View Article

EBA reaffirms its commitment to support green finance in view of the UN Climate Change Conference : EBA published its environmental statement in the context of COP26, highlighting its efforts to update and enhance the entire supervisory and prudential regulatory framework in the environmental, social and governance (ESG) domain. View Article

Protecting Customers

ESMA/EBA: GUIDELINES ON THE ASSESSMENT OF THE SUITABILITY OF MEMBERS OF THE MANAGEMENT BODY AND KEY FUNCTION HOLDERS 1 : These Guidelines set out appropriate supervisory practices within the European System of Financial Supervision and regarding how Union law should be applied. View Article

Economic Policies Impacting EU Finance

OECD Secretary-General Mathias Cormann welcomes outcome of the G20 Leaders Summit : At their summit in Rome this weekend, G20 leaders called on the OECD/G20 Inclusive Framework on BEPS to develop the model rules and multilateral instruments swiftly, to ensure they come into effect globally in 2023. View Article

EURACTIV: ESM economists want to raise public debt limit to 100% of GDP : The European Stability Mechanism’s economists are unlikely radicals. The ESM is responsible for providing emergency fiscal support to member states in case of financial distress. View Article

Brexit and the City

Federal Trust - Graham Bishop: Is the City of London’s tumbril drawing closer to the scaffold? : Should the EU sub-contract vital parts of its financial infrastructure to a “third country”? Is that third country a reliable partner who can be trusted - in a moment of crisis – to act in the best interests of the EU, especially if there may be large costs involved? Many would say No. View Article

City of London Corporation welcomes UK plans to become the world’s first net zero aligned financial centre : The Chancellor Rishi Sunak made a speech this morning [3 November] at COP26 Finance Day in Glasgow, where he announced plans for the UK to be the world’s first net zero aligned financial centre. View Article

Sewing: ISSB in Frankfurt a major success : Christian Sewing, President of the Association of German Banks, on the decision of the IFRS Foundation to base the International Sustainability Standards Board (ISSB) in Frankfurt am Main, Germany: View Article

FT: UK pushes back deadline for Basel III update : Latest version of banking standards will come into force ‘post March 2023’ View Article

Follow us on

About this email

If you do not wish to receive these e-mails, please click this link If you wish to add a colleague, please inform: office@grahambishop.com

Euro Crisis Limited PO Box 2002, Battle, East Sussex, TN33 0WL, UK Tel:+44 (0)1424 777123 Email: office@grahambishop.com (Registered in England and Wales No. 7984039)

|